1 Which of the Following Are Progressive Taxes

Federal taxes operate under a progressive system. 10000 per annum pays a tax of 25 ie Rs2500 and a person with an income of 1 lakh.

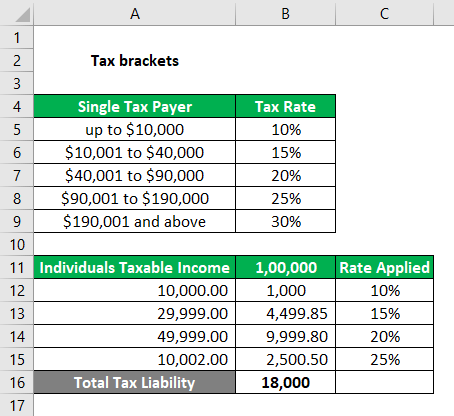

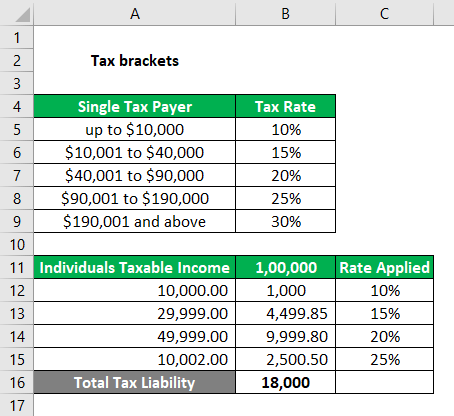

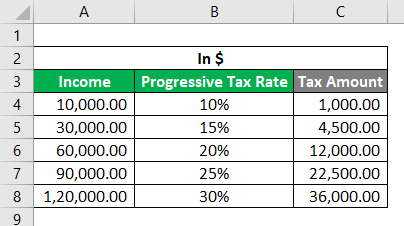

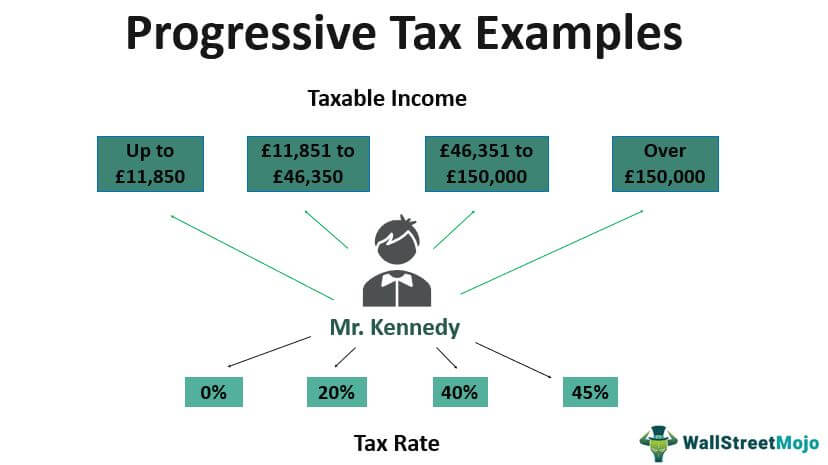

Progressive Tax Examples Top 4 Practical Examples Of Progressive Tax

1 point progressive tax.

. Select the correct answer using the codes given below. B A tax whose rate rises less than in proportion to income. Find more tax loopholes.

Answered Jul 1 2021 by riyapreprise 453k points b Tax rate increases. Which one of the following represents a progressive tax structure. Exempt from Philippine income tax d.

A form of taxation in which everyone pays an equal rate of taxes is called a _____. The tax rate structure they are subject to. Custom tax 3sales tax 4.

B Tax rate increases as income increases. Which of the following taxes is progressive. Every year we have to pay a fixed portion of our income to the central government in the form of income tax.

B Tax rate increases as income increases. Federal corporate income tax Excise tax Federal individual income tax Sales tax Social security tax Explanation. Excise taxes are based on a proportional rate structure.

A progressive tax is directly related to the taxpayers ability to pay. This is a Most important question of gk exam. 100 1 rating Answer1-Option a is the correct answer.

Along with the return David remits a check for 40000 which is the balance of the tax owed. Indirect taxes have the advantage of being cheaper and easier to collect. Jill earned 40000 and paid 3500 of income tax.

In 2021 federal progressive tax rates are 10 12 22 24 32 35 and 37. Disregarding the interest element Davids total failure to file and to pay penalties are. View FIT EXAM 1 FOR FALL 2020 2021 TBDdocx from ATG 158 at Maine East High School.

2In general lower marginal tax rates provide incentives to. The correct answer is the Income-tax. Ltd and renew power have agreed to form a joint.

Subject to the 20 final tax on passive income b. Which one of the following represents a progressive tax structure. Ii Progressive Taxation is a method by which the rate of tax will also increase with the increase of income of the person a case of progressive taxation if a person with Rs1000 income per annum pay a tax of 10 ie Rs100 a person with an income of Rs.

Explanation-progressive tax is which increases with an increase in taxable income and vice versaFederal income tax is a type of tax which impose high tax on high income and low or no tax on low inco. Tax rate is the same across all incomes Tax rate increases as income increases Tax rate decreases as income increases Each household pays equal amount of tax. Subject to 32 final tax starting year 2000 c.

Subject to 5 tax on gross income allowed to PEZA-registered enterprises. A form of taxation in which the highest income earner pays the largest percentage of taxes is called a _____. Which one of the following represents a progressive tax structure.

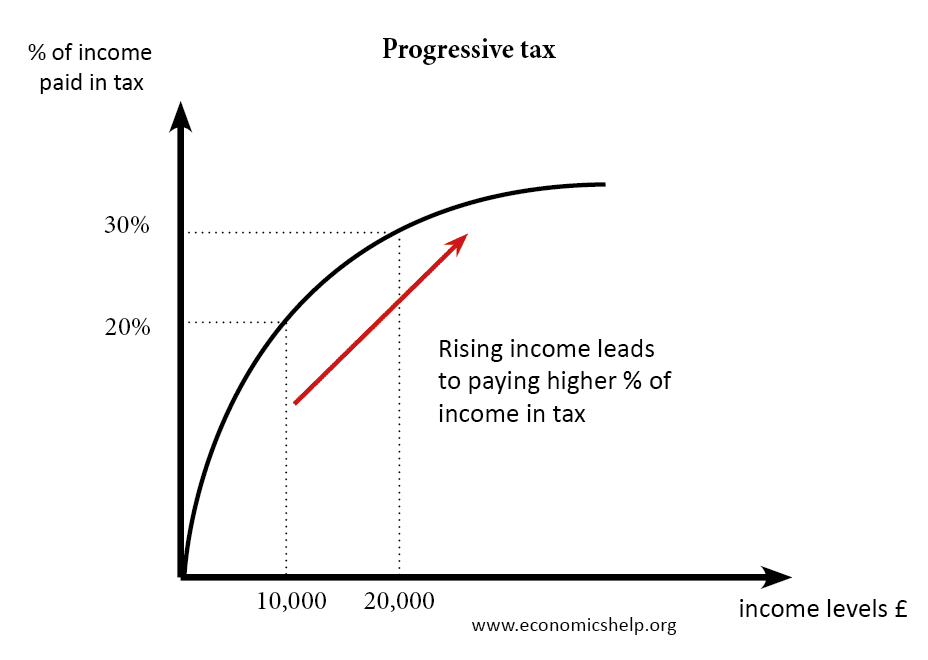

Context the union culture ministry has established the temple 360 webpage. Progressive Tax. A A tax that takes a higher percentage of income as income rises.

D Each household pays equal amount of tax. 1 point a credit a holding a deduction an exclusion 4. Which of the following taxes is a progressive tax.

Part of solved Nature of Indian Economy questions and answers. 5David files his tax return 45 days after the due date. 1 point progressive tax regressive tax flat tax net tax 5.

Which of the following taxes uses a progressive tax rate structure. 3If the tax elasticity of supply is 06 and tax rates increase by 10 percent the. Multiple Choice Social security tax A sales tax A proportional tax US.

General Knowledge Economy Nature of Indian Economy. It is a progressive tax since the tax due increases as wages increase. Options is.

C A tax that takes a fixed percentage of income regardless of the taxpayers level of income. The sales tax is based on a proportional rate. C Tax rate decreases as Income increases.

1 income tax 2 custom tax 3 sales tax 4 excise duty. Context larsen and toubro indian oil corp. A progressive tax takes a larger share of tax from poor families that does from rich families.

We review their content and use your feedback to keep the quality high. Jitendra singh the union minister of state independent charge for science and. A Tax rate is the same across all incomes.

One of the following inhabitants is not required to pay basic community tax. Which of the following taxes is a progressive tax. Which of the following is an example of a progressive tax system.

Engaged in business or occupation b. Corporations are subject to a flat tax at a rate of 21. This is a one-of-a-kind.

A Tax rate is the same across all incomes b Tax rate increases as income increases c Tax rate decreases as income increases d Each household pays equal amount of tax. Jake earned 15000 and paid 1500 of income tax. A sales tax B.

Progressive Tax Economics Help

Progressive Tax Examples Top 4 Practical Examples Of Progressive Tax

Progressive Tax Examples Top 4 Practical Examples With Calculation

Comments

Post a Comment